POW#6 - Compound(COMP)

Article Summary :- Passive income generation on assets owned is vital. Similar to how Banks offer interest rates on your deposit funds. In this article, we will attempt to briefly cover evolution of methods to generate passive income & how it creates lending markets. Subsequently, we will cover Compound Protocol (COMP token) in detail to understand how a decentralised application can help you generate income on Crypto assets owned.

Introduction

If you are a crypto investor, you may have actively wondered on “how much to invest & in which tokens” ? However, once invested, next question to consider is “what to do with the invested assets ? ”. This is a major consideration specially for long term holders.

If you are a new user, chances are you are leaving it in the centralised exchange platform( Coinbase, CoinDCX) itself. This , however, is not very prudent due to security considerations & lack of options for passive income generation on invested assets. Few of the more mature users might be transferring it into non-custodial wallets such as Metamask.

You have few options to consider for passive income generation at the moment.

Few of the centralised exchanges such as Binance do offer margin trading. However, centralised exchanges are not unregulated & prone to hacks/attacks/Theft. You can dive down on the topic here.

Few P2P lending options such as BlockFi are available. However, it is slow & relatively cumbersome. In addition, the organisations operating in this segment faces regulatory uncertainty.

The third category of option involves Decentralised applications. We will break-down one such application, Compound, below.

Traditional P2P vs Intermediary based Lending

Peer to Peer lending is the oldest method for borrowing & lending wherein tight-nit communities would borrow and lend amongst each other. Such form of “Social Lending” was built on top of existing checks & balances that come naturally in the small communities. For example, an individual with extra assets would loan it to neighbours or neighbours relatives. In return, the lender of assets would expect it back with some interest. Similarly, the borrower could avail the assets to sow it fields or start a new business. From the profits generated, borrower would pay back the loan amount. In case the business failed or the fields sown did not produce expected result, it was very easy in small communities to verify the same.

Any borrower who knowingly refused to repay would face ostracisation from Lender & others in the community would not led him any further. The cost of ostracisation was also very high in such tight-nit communities in earlier times. However, as expected, the scale of lending was very small & dispersed across in smaller groups.

In order for strangers to be able to borrow & lend from each other, trust was vital. Hence, the intermediaries such as money lenders & , eventually, Banks were required. The emergence of intermediaries such as Banks had multiple advantages :-

Intermediaries such as Banks would pool in deposits from savers & create a large pool of cumulative assets. Savers would earn interest for deposited assets.

Borrowers would connect with Banks & borrow from this larger liquid joint pool instead of finding individual lenders willing to lent the needed amount for required duration.

Banks would ensure trust between transacting players & would create elaborate sophisticated mechanism to calculate interest rates, control & value collateral from borrowers.

These intermediaries would also perform collection of repayments.

For individual with assets, as long as Banks did not go bust, the funds earned guaranteed passive income without the need to look for lenders & engage in negotiation over interest rate/Lending period.

In the pre internet world, Banks increasingly became the dominant & preferred channel for both Depositors & Borrowers & direct P2P lending stayed relatively small in comparison.

Internet Based P2P Lending

With the rise of internet, internet based start-ups did appear to make P2P lending feasible on large scale. Few reasons for traction of such P2P platforms were :-

Banks are heavily regulated & made borrowing extremely taxing for certain category of Borrowers.

The cost of compliance, slow manual paper driven process & high Brick & Mortar branch based approach on behalf of banks resulted in higher costs & hence high borrowing rates.

The MSMEs operating in risky & volatile industries found it even more difficult to avail capital from traditional banks.

Such internet based start-ups though are still intermediary based. It is just that nature of intermediation differs. Such P2P platforms are essentially more like marketplaces which match Lenders & Borrowers as per their requirement . However, Internet based P2P lending platforms had few advantages:-

Low Capex due to no requirement of physical presence

Ability to curate purely paperless digital experiences for Depositors & Borrowers

Intermediary only facilitates discovery & matching of parties, risks were borne by parties involved

Such platforms also offered lower rates compared to moneylenders & loan sharks for low credit profile borrowers.

Depositors were able to earn higher returns compared to Bank savings deposit rates.

According to some estimates, the market for P2P lending has been growing at 30% since 2017 & is estimated to be over $ 290 Bn + by 2023.

However, even such P2P Lending platforms have still largely played second fiddle to bank based lending market. Examples in US are Peerform, upstart, Lending club etc.

P2P Lending in India

As mentioned above, the advantages derived by P2P lending platforms derive due to lower cost structure & ability to innovate with digital technologies. However, regulation has put brakes on this nascent industry in India.

RBI has attempted to define structure for this industry since 2017 & issued guidelines for the same. However, such regulations have increased the compliance burden for start-ups operating in the segment & additionally increased cost for new players to enter.

As part of regulatory guidelines, the platforms offering P2P lending feature need to obtain license from RBI under the category NBFC-P2P. RBI imposes certain constraints with respect to asset size of the platform. In addition, such platforms cannot take deposits & give loan out to borrowers directly. The primary role of the platform is defined around :-

Enable co-ordination between Lenders & Borrowers

Profile detailed information of Borrower to Lender

Credit Risk assessment

Recovery of payments

data reporting to Credit Bureaus

Profile verification

Around 20 companies have been licensed by RBI under this category. The market of P2P borrowing & lending is expected to $4-5 billion industry by 2025.

Few of the P2P platforms operating are Faircent, LendenClub, RupeeCircle .

While the internet based P2P lending market will continue to grow in India, it is unlikely to to become a major breakthrough industry with the defined regulations imposing constraints.

As crypto investment becomes democratised & familiar, Crypto based platforms with P2P inbuilt could truly usher in a new era into how lenders & borrowers could transact seamlessly with each other without intermediaries & without the need for cumbersome KYC.

Crypto Based lending

Crypto assets as investment option have increased in popularity in recent years. So, naturally it was expected that borrowing & lending market to evolved around this asset category.

You may associate crypto primarily with decentralisation. However, there are quite a few centralised players operating on the theme of “crypto asset backed loans”.

Few such examples are BlockFi, Salt , Celsius. These players operate a very similar structure to banks:-

They have custodial ownership of crypto assets on behalf of its users. This implies that in case of absence of regulations & defined customer protection rights, the risks to depositors are very high.

Such platforms also perform KYC for its users.

Such platforms decide interest rates based on its internal process & parameters.

Therefore, such platforms are akin to Banks for crypto assets.

Such platforms are not regulated yet & the regulatory clarity on such centralised platforms offerings lending & borrowing services on crypto assets are still not available. Recently, Coinbase, one the most popular centralised crypto exchanges, scrapped its plan to offer lending & borrowing features due to regulatory pressure from SEC.

In contrast , the core tenet of crypto is built around the theme of decentralisation wherein Users interact directly with each other through protocols & without any intermediary. Crypto native platforms do adhere to such espoused themes of Decentralisation. Consequently, P2P lending & borrowing market is likely to get a new lease of life. Decentralised P2P crypto based lending could very well be the future because of its speed & convenience ( no KYC, No paper work ).

Compared to Internet based P2P platforms, one major advantage crypto based applications is that KYC is not required & instead of internal organisation controlled methods of deciding Interest rates, Smart contracts play the vital role of deciding interest rates based on certain factors such as demand & supply of the underlying asset.

MakerDAO was the first major project to revolutionise the lending & borrowing use case. You can read on it in detail here. Maker , though, uses a governance structure & its community of token holders to decide on interest rates charged to lenders.

Another major project, Compound, instead uses supply & demand to algorithmically adjust interest rates without any manual intervention.

Why Compound?

Before getting in to “What is Compound” & “ How it works”, it is essential to have view on “Why Compound”? It would help the reader visualise the various use cases that the Compound protocol makes feasible & the possible roadmaps for the future.

Few Problems

The market making mechanisms on Crypto are very limited that enable complex use cases such as borrowing, lending, shorting etc. This is one the key reasons as to why few obvious Shitcoins are gamed to skyrocket in value. If there were enough methods to short such assets, true value of tokens could be more apparent.

In addition, storage of tokens has risks & hidden costs, both on centralised exchanges & in non-custodial wallets. Lack of options to generate passive incomes is severe deterrent.

Few centralised exchanges do offer borrow & lending capability with inbuilt Marketplaces to facilitate the same. However, as repeated countless time earlier, the risks of theft & unilateral action from centralised players are very high.

Compound as protocol primarily enables users to earn passive income on its assets & borrow against it any other asset. The protocol is permissionless that means user profile & Credit Score is irrelevant. As long as you have few assets, you can connect to protocol & start earning/borrowing right away.

Additionally , Compound enables users to gain exposure to new assets by borrowing it against the Supply. As long as the price rise is higher than Borrow APY, users will have profit. Such type of leverage is highly secure due to Smart Contracts. The alternate of high leverage through centralised exchanges is highly risky in comparison.

Compound as money market maker enables more dynamic uses cases for crypto assets. Consider 2 such scenarios below:-

Say you as an investor are optimistic of BAT token price increase. As an example , you could deposit your existing 5000 BAT token assets to Compound.

Consequently , you borrow , say, 2 ETH from the Compound protocol , using deposited BAT tokens as collateral.

You can now use the borrowed ETH tokens to Swap additional 1000 BAT tokens on Uniswap.

You now have exposure to over 6K BAT tokens.

If BAT/ETH price appreciates significantly, you will easily be able to repay the borrowed 2 ETH tokens at a handsome profit.

Similarly,

Say you are bearish on BAT token prices.

You deposit your 2 ETH tokens on Compound & use it to borrow additional 2000 BAT tokens.

You will now swap the additional 2000 BAT tokens for 2 ETH on Uniswap.

You now have exposure to total 7 ETH tokens.

If BAT/ETH prices depreciates significantly, you will easily be able to sell the extra ETH for higher BAT Tokens & repay to Compound protocol for profit.

What is Compound?

Compound is a permission less lending protocol built on top of Ethereum.

In simple terms, Compound is a ledger on Ethereum that maintains record of Lenders (Depositors) & borrowers and computes interest rates dynamically based on supply & demand.

Compound takes in assets from each user deposits & pools them together in a liquidity pool. No KYC or login is required. Simply connect to the protocol using your wallet containing the assets & deposit your assets. The assets are deposited in extensively audited Smart contracts. Compound protocol is on 24*7 with no geographical limitations ( except where the protocol might be banned at ISP level).

Borrowers can borrow any asset from the pool against the assets deposited. In a way it is similar to how collateral based loans from Banks work. The core difference is instead of individuals, Computer codes play primary role in enabling this market. All the relevant parameters required for both suppliers & borrowers such as savings rate & borrowing rate is done through smart contracts & is adjusted based on demand & supply of the asset.

Creating a combined pool has several advantages:-

Individual depositors can deposit & withdraw the assets without any time constraints.

The deposited assets are not controlled by any external entity. User is always in direct control of funds , while earning passive income. The Smart contracts deployed on Blockchains control the assets.

Borrowers have higher chances of availing required amount for the required duration since combined pool will be large.

Individual level bargain on interest rates & lending duration between Borrowers & Lenders is avoided.

How is Interest Rate decided?

Interested is adjusted in real time based on supply & demand for the underlying assets , instead of whims on Bankers. For example , if a certain asset’s liquidity is increasing, the interest rates will go down. This incentivises borrowers to take out loans & discourages new Depositors to add to the pool.

Alternately, if liquidity is low or going down considerably , interest rates will be adjusted higher so as to incentivise suppliers to deposit assets. In addition, it also incentivises repayment from existing borrowers to increase liquidity.

You can view the variation in interest rates & deposits the last 60 days here for all major assets on Compound. After navigating to the page , click on any asset. For example , below you can see how the interest rates have fluctuated for ether.

You can see how the size of total deposit is inversely correlated with interest rates.

One variable to notice is the difference between Supply APY & Borrow APY for any asset. For example, for ethereum above, the Supply APY is 0.09%. Whereas in the Borrow tab, the borrow APY is 2.79% for Ether.

This is primarily because at any time, Supply Asset Pool must be > Borrowed assets. The earning from relatively smaller borrow assets base is distributed among larger supplier pool. Hence, the difference.

Actually, the interest payment received from Borrowers are distributed between Suppliers & the Compound protocol as well. The protocol fee collected from repayments is maintained in reserves & is under aegis of the COMP protocol governance.

cTokens

After you supply your asset tokens into the protocol , your balance is represented through cTokens. Based on amount of asset supplied, users receive equivalent cTokens in return. The interests are incurred as per Supply APR of the asset in cToken itself. This helps the protocol avoid constant interest payouts to users wallets since it will be very expensive with gas costs incurred for each transfer transaction. Based on the net worth of cTokens, your borrowing limits are decided. You can also transfer cTokens into your wallets for using it elsewhere, however this will impact your borrowing limits & increases risks of liquidation.

How to use Compound?

Navigate to https://app.compound.finance/ . There are other implementations of the same protocol available such as Instadapp.

On this page , you will be asked to connect your Wallet. Wallets such as Metamask enable you to safeguard your private keys & interact with Ethereum blockchain. For more in depth understanding on wallets , refer this article here.

After connecting your wallet, you will able to view your address on the top right corner of the screen. You will also see “Supply” & “Borrow” balance displayed on top . The initial value for first time user is ,expectedly, $0.

You can also view 2 columns - one on the left listing all Supply assets that you can deposit into protocol for earning passive interest income and the one on the right has list of assets you can borrow at certain interest rates.

Supplying Assets

As on October, 2021, there are around 15 assets available for supply & Borrow.

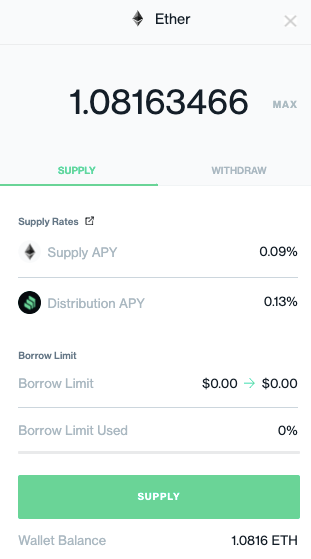

Click on the asset that you have in your wallet & would like to deposit to the protocol. On the pop-up that appears next ( see image below), you will view the annual supply tokens you will earn ( Supply APY). The second variable - Distribution APY -denotes annual native protocol token(COMP ) that you will earn.

The asset selected needs to be enabled first. This is required so that Compound protocol Smart contracts can interact with the assets in your wallet. The confirmation is a one time action & requires small gas fee.

Once enabled, the “Supply” button will appear. You can type in the amount of asset you would want to apply from your balance. You can select MAX option to deposit full wallet balance.

Click on “Supply Button” & confirm. This is second transaction & will again cost additional gas fee. As you can see below, Ethereum is quite congested & gas fee is very high.

Once the transaction is submitted, you assets have been moved into Compound Smart Contracts & will start accruing interest.

If you now navigate back to the home page, you will se that “Supply Balance” has increased to account for assets submitted. As you earn more interest, the balance will increase further.

On the top right corner, based on distribution APY, you will be able to view & claim native “COMP” tokens earned.

Once you have few COMP tokens earned, you can transfer it to your wallet.

Assets Withdrawal & Borrowing

Post depositing your assets, you can withdraw any amount at any time. This is feasible since only a part of the larger pool is lent out & hence liquidity for withdrawal is available.

Alternately, while you assets are deposited, you can borrow any other supported asset from the protocol using your supply as collateral.

Your borrowing capacity against a submitted collateral asset is dependent on 2 major factors - the total asset amount deposited & volatility of the asset.

Each asset has a defined “Collateral Factor”, ranging from 0 to 1, which indicates the borrowing capacity against the deposited asset amount. As you can intuitively imagine, a volatile asset will have lower collateral factor compared to a stablecoin such as Dai.

If you have more than one assets deposited of varying collateral factors, the combined collateral factor is determined. The collateral factor os each asset is decided by the “Governance team i.e. COMP Token Holders”.

In order to borrow, click on the asset from the available “Borrow list”.

A pop-up will appear showing the annual token you will need to pay as interest ( Borrow APY) & the native token you will earn( Distribution APY).

You can specify the borrow limit . The specified limit of your choice will affect the overall Borrow limit displayed on Home screen. You need to constantly monitor this rate to avoid liquidation of your collateral , in case Borrow limit exceeds 100%.

Once the rate is specified & submitted, the selected asset is deposited into your connected wallet.

Liquidation Process

If the borrow limit crosses 100%, say due to sudden price crash of your assets, your assets will be liquidated.

This is done to secure the protocol from default.

As part of liquidation process, a compound community member will repay part of the collateral on your behalf. This will bring the breached borrow limit to below 100%.

The “collateral Payer” receives your assets as reward at a discount. This reward at discount is required to incentivises new users to payback the due amount.

If few of your assets are very dear to you, you can chose to disable few of the assets deposited from considering it as a Collateral. This will however affect your existing borrow limit further. But even in case of liquidation, that particular asset will not be sold to the liquidator.

Governance Mechanism

Compound protocol is controlled by COMP token holders. You can view the top COMP token holders here.

Anyone with more than 100 COMP token can raise proposals for making changes to the protocol. If the suggested changes gather support from more than 100,000 COMP tokens , then the proposal is put to vote.If the proposal is passed, then changes are executed to the protocol within 2 days. You can view the previous & ongoing proposals here.

The governance process is aimed at deciding on Protocol parameter such as Collateral factors , APRs etc.

COMP Token Distribution & Few early challenges

While COMP tokens can be availed form exchanges, there is an inherent protocol native mechanism to distribute COMP tokens to lenders & borrowers on the platform.

The COMP token distribution is decided based on total interest accrued across all asset categories. For example, if BAT asset class has generated 20% of total interests accrued, the COMP token rewards will be proportional. With the initial launch, users found unique to earn COMP relatively risk free. Users would supply USDC to the protocol & borrow USDT in return. Both the USDC & USDT are stablecoins with little risks of liquidation & hence such users were practically earning COMP token at little risk. Since then such methods are not permitted on the platform.